“After the tumult of 2022, a global recession is inevitable. The question is what comes next.” – Zanny Minton Beddoes

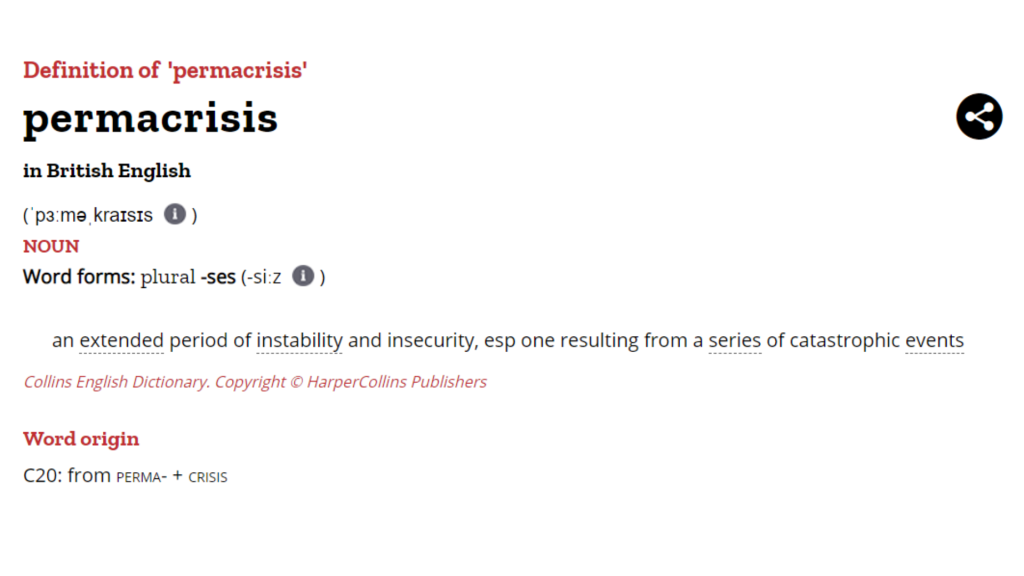

permacrisis

The Editors of the Collins English Dictionary have declared “permacrisis” to be their word of the year for 2022. Defined as “an extended period of instability and insecurity, it is an ugly portmanteau that accurately encapsulates today’s world as 2023 dawns. Vladimir Putin’s invasion of Ukraine has led to the biggest land war in Europe since 1945, the most serious risk of nuclear contamination since the Cuban missile crisis and the most far-reaching sanctions regime since the 1930s. Soaring food and energy costs have fueled the highest rates of inflation since the 1980s in many countries and the biggest macroeconomic challenge in the modern era of central banking. Assumptions that have held for decades – that borders should be inviolable, nuclear weapons won’t be used, inflation will be low and the lights in rich countries will stay on – have all been simultaneously taken.

Three shocks have combined to cause this turmoil. The biggest is geopolitical. The American-led post-war world order is being challenged, most obviously by Mr Putin, and most profoundly by the persistently worsening relationship between America and Xi Jin-ping’s China. The resolve with which America and European countries responded to Russia’s aggression may have revitalised the idea of “the West”, particularly the transatlantic alliance. But it has widened the gap between the West and the rest. The majority of people in the world live in countries that do not support Western sanctions on Russia. Mr Xi openly rejects the universal values upon which the western order is based. Economic decoupling between the world’s two biggest economies is becoming a reality; a Chinese invasion of Taiwan is no longer implausible. Cracks are also appearing in other longstanding geopolitical certainties, such as the alliances of convenience between America and Saudi Arabia.

The war in Ukraine, in turn, has led to both the biggest commodity shock since the 1970s and a warp-speed reshaping of the global energy system. Ukraine’s importance as an agricultural exporter meant that war threatened mass global hunger, until a means was found to open the port of Odesa. Even now, for many countries the most immediate consequence of a far off-conflict has been dearer food and fertiliser. Mr Putin’s willingness to weaponize his gas exports exposed Europe’s chronic dependence on Russian hydrocarbons, rendered swathes of its energy-intensive industry unviable overnight, forced governments to spend billions cushioning consumers and prompted a mad scramble for new sources of supply. And all this in a year during which the consequences of climate change, from floods in Pakistan to heatwaves in Europe, became ever more violently visible. With soaring energy costs prompting even the greenest European politicians to turn mothballed coal plants back on again, stark trade-offs have appeared between ensuring energy supplies are affordable, secure and environmentally sustainable.

From Spike proteins to spiking prices

Spiking energy prices, in turn, have exacerbated the third shock, the loss of macroeconomic stability. Consumer prices were already accelerating early in 2022 as stimulus-fuelled demand met post-pandemic supply constraints. but as energy and food prices rocketed, inflation went from seemingly temporarily elevated to being a persistent, double-digit problem. Led by the Federal Reserve, which belatedly discovered its inner Volcker, the world’s big central banks undertook the fastest and broadest set of global rate increases in at least four decades. Yet as 2022 draws to a close macroeconomic stability is still far off: global inflation remains close to double digits and comparisons with the 1970s are uncomfortably close.

What happens next? It all depends on how these three shocks — geopolitical, energy and economic — evolve, and how they affect each other. In the short term, the answer is grim. Much of the world will be in recession in 2023, and in several places, economic weakness could exacerbate geopolitical risks. This poisonous combination will be most evident in Europe. Notwithstanding the mild autumn and resultant dip in energy prices, the continent faces difficult winters in 2022-23 and 2023-24. Many European economies are already on the edge of recession. The higher interest rates needed to dampen inflation will further sap consumer spending and increase unemployment.

A cold snap would send gas prices soaring and raise the real prospect of blackouts. so far European governments have protected consumers from the worst of the energy-price shock with massive subsidies and price caps. That cannot continue indefinitely. Britain is in the worst shape, thanks both to the lasting damage from Brexit and the self-imposed harm done by Liz Truss’s plan for massive unfunded tax cuts. To rebuild market confidence after the irresponsibility of her premiership, Britain will have to undertake the biggest fiscal tightening in the G7 club of big rich countries, even as it suffers the deepest recession. Italy, the long-standing European laggard which Britain now rivals, is also a worry.

The biggest geopolitical risk is that Mr Putin, unable to succeed on the battlefield, tries harder to exploit these European vulnerabilities. This strategy is already evident in Ukraine itself, where Russia is doubling down on trying to destroy the country’s energy infrastructure as winter approaches. So far Mr Putin’s attempts to break the solidarity of backing for Ukraine in western Europe by weaponising gas have failed. But he could go much further, by cutting off all (rather than some) gas exports or by sabotaging Europe’s own gas pipelines. Escalating in this way would result in less opprobrium from the rest of the world than the use of tactical nuclear weapons. But it would mean things getting much worse in Europe.

A second place where economic weakness could worsen geopolitical risk next year will be China. Its economy will enter 2023 enfeebled by its own set of home-grown policy mistakes, notably Mr Xi’s determination to stick with his zero-covid strategy and the failure to deal with a vast, festering property crisis. At the same time, Mr Xi has dialled up his aggressive, nationalist rhetoric, especially over Taiwan. At the five-year party congress in October that formalised his absolute concentration of power, Mr Xi warned of “dangerous storms” ahead and referred to “gross provocations” involving “external interference” in Taiwan. Prizing loyalty over competence, he no longer has any experienced economic technocrats around him. If China’s economic woes worsen in 2023., sabre-rattling over Taiwan might prove a tempting distraction.

America’s economy enters 2023 in fundamentally stronger shape than either China’s or any in Europe. The Federal Reserve’s aggressive rate increases will tip the economy into recession, but with the labour market still strong and household saving copious, it will be a mild one. Although high petrol prices have reinforced the inflation surge and hurt the Biden administration, the country is a big energy producer and has therefore benefitted from this year’s commodity shocks. Paradoxically, in 2023 America’s relative economic strength could prove more of a problem for the rest of the world than its weakness. The Fed will need to raise rates further for longer to quell inflation, in turn reinforcing the dollar’s strength and obliging other central banks to keep up. Domestically, the danger is that a divided government and even a mild downturn will mean legislative sclerosis and yet more poisonous politics than usual in Washington. In that environment, support for assisting Ukraine could fade and the appeal of performative toughness over Taiwan would rise. The former would embolden Mr Putin; the latter enrage Mr Xi.

In Short, there are plenty of reasons why 2023 will be a grim and potentially dangerous year. But because every crisis spawns new possibilities, there is some good news amidst today’s tumult. Some economies of the Gulf are booming, for example, gaining not only from high energy prices but also their growing role as financial entrepots. India, which will overtake China to become the world’s most populous country in 2023, will be another bright spot, buoyed by discounted Russian oil, growing domestic investment and rising interest from foreigners keen to diversify their supply chains away from China. Broadly, emerging economies will fare relatively better than in previous episodes of rising interest rates and global recession.

The shake-up will lead to some questioning of orthodoxy. As inflation is gradually and painfully brought under control, central bankers will question how far they should push their toughness. Few are likely to get anywhere near their 2% targets for inflation and there will be an increasingly vocal debate about whether this is really the right goal to aim for.

Ukraine’s silver lining for the climate

Meanwhile, the energy shock will boost the shift to renewables: Fatih Birol, the head of the International Energy Agency has called it “a turning point in the history of energy” that “will accelerate the clean-energy transition”. At the same time, the crisis will also encourage greater realism about the ongoing role of fossil fuels, and in particular the role of natural gas as a bridge fuel to a greener nature. With luck, long-standing hypocrisies will, at last, be confronted– such as Europe’s unwillingness to finance gas projects in poor countries, even as it scrambles to secure more gas supplies for itself– and the result will be a global energy system that is greener, more diverse and more secure.

the long-term geopolitical consequences of the shocks are 2022 are the hardest to foresee. Whatever transpires in Ukraine, it is evident that Mr Putin will fail in his strategic aim of denying the country’s right to exist. Instead, Ukraine will be a Western-oriented country with the biggest and most battle-hardened army in Europe. Even if it is outside NATO, that will transform Europe’s security calculus. And Ukraine’s success should give other would-be aggressors pause for thought. Yet the refusal of most emerging economies to sign up to the West’s sanctions regime against Russia suggests that the broader appeal of standing up for democratic freedoms and the right to self-determination is limited. As 2023 begins, the post-war order is not dead– but it has been reformed.

—

Article from The Economist, The World Ahead 2023, Page 11 – 12, by Zanny Minton Beddoes, Editor-in-chief of The Economist.

All rights reserved to the respective owners and authors of the article.